|

Brokerage Deals/REO (Real Estate Owned) Property Specialists |

||

|

|

|

|

|

||

| As REO Specialists, Francis T. Zappone CO. has been providing outstanding, professional service to banks, financial institutions and government agencies for many years. Among our satisfied REO clients are Countrywide Home Loans, Fairbank Capital, Select Portfolio Servicing, Citicorp, Dime Savings, HSBC/Midland Marine, Wilshire Credit Corp., Clayton National, Integrated Asset Services, Northwest Mortgage, First Union, North American Bank, Webster Bank, Thomaston Savings Bank, Ocwen Bank, Wells Fargo, Bankers Trust of California, American Bank of Connecticut and many others. Many of our clients have expressed to us that we provide such a professional level of service that they would prefer to deal exclusively with us. | ||

| Based on our more than 50 years of experience, please be assured that the REO staff of Francis T. Zappone CO. is one of the few companies in the area that is fully staffed with REO personnel and vendors who are very experienced in this specialty of Real Estate analysis, securing and managing the property, providing proper feedback and documentation and ultimately disposition of the asset for our REO client. | ||

| REO (Real Estate Owned) In Today's Marketplace | ||

| Many Investors and owners who purchased property during the boom years in Real Estate have found that their mortgage balances are far in excess of market value of the property when the market adjusts. For them, selling is an option only if they can come up with enough "out of pocket "cash to satisfy the difference between the sales price and the mortgage amount. If they are unsuccessful, foreclosure becomes a reality. In many instances, the foreclosing party is an out of state entity, as the original lender may have sold the loan or may even have been taken over by another entity. Often, foreclosing lenders never see the properties which they sell. this is why it is imperative for them to work with real estate professionals who will accurately and honestly price their properties. Handling lender owned properties involves much more than simple marketing for the REO Broker. The foreclosure process can take quite a while, often upwards of a year. During this time, the property will often be abandoned until the foreclosing institution is awarded title. During this abandonment, the property may be vandalized, burglarized or generally suffer from neglect. Of course, one of the most common problems with foreclosures in the Northeast is frozen pipes. A great deal of damage can occur to the plumbing system when a property is left vacant and unwinterized without heat during the winter. Thus, the lender will often rely upon the broker to handle the immediate repairs to the property and to secure it, requiring several bids for each job. An experienced REO Broker must have many contractors to work with, as well as an in-depth understanding of construction and remodeling work. Once the agent has completed the inspection, he or she will prepare a broker price opinion, or BPO. Using comparable sales in the market area, the agent arrives at an opinion of value for the property. The agent will actually furnish the lender with two values, one for the property in repaired condition and one for in "as is" condition. This gives the bank an option on how to sell it. Some lenders prefer to sell properties in "as is" condition and take less money rather than repairing them. A common misconception among buyers is that a bank or other lender foreclosures are sold well below market value. Lending institutions will use not only the BPO, but also an appraisal by a licensed appraiser in deciding what to sell the property for. In fact, most lenders have policies as well as regulatory requirements which indicate that they can only sell a property if the sales price is within a certain percentage of the appraisal value. The major difference between lenders and private sellers is that the lenders are not encumbered by mortgages in excess of market value. Also, many of the foreclosures that do sell below general market value require a great many repairs. While there are bargains to be had in purchasing foreclosed properties, lenders are very aware of market conditions. | ||

|

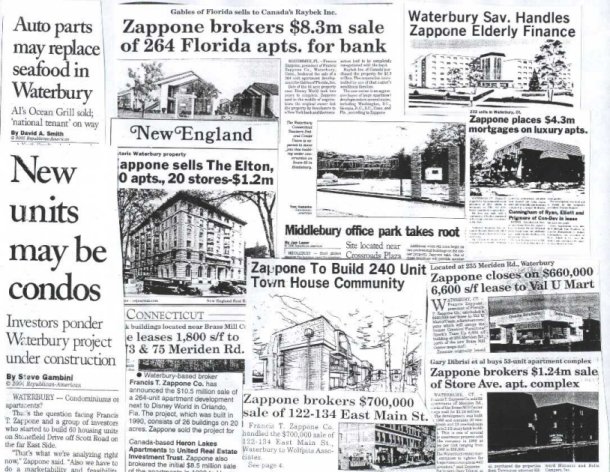

Random Sampling of Closed Deals... |

||

|

|

||

|

|

||